June 2022

What funding options are available in the market? What is the appropriate funding structure for my business? What information do lenders require when assessing funding applications? – just a few of the most commonly asked questions in my recent discussions with portfolio clients and local NI businesses.

These discussions brought to light how much the funding landscape in Northern Ireland has changed, particularly in the last 10 years. Starting out as a graduate in 2005 it would have been rare to see more than one funder involved in a company or group, with most businesses having been with their funder since inception. Whilst it continues to be great for businesses to maintain strong relationships with long-term funders, there has been a notable shift in mindset with more NI SMEs now availing of an array of funders and tailored products.

The last 12 months have been a whirlwind for most businesses with many decisions having to be reactive as management sought to quickly manage the uncertainty and impact of COVID-19 as best as possible. During this period businesses will have availed of various COVID-19 initiatives to assist them to trade through the position. This is likely to have included a mix of grants and debt through CBILS/BBLS.

For many businesses the “new norm” may look very different to what the business was 12 months ago and the prospects going forward will have changed. Management need to make a fresh assessment of where the business is, what the strategic plans are going forward and in conjunction think about the financing options available. As with most things, there is no one size fits all in relation to funding structure and it is key that management assess the funding requirement and the most appropriate structure to support the business in meeting its objectives.

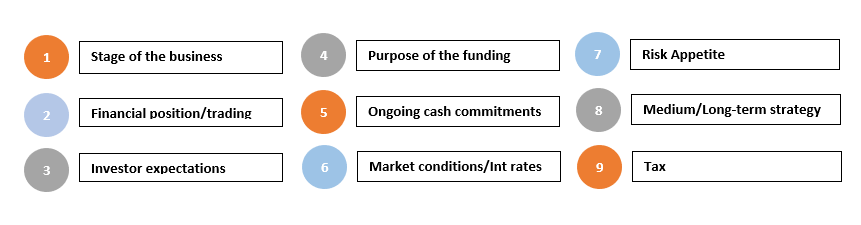

Businesses have two choices in respect of fundraising activities: debt or equity, with the optimal choice often a combination of each. The appropriate funding structure will be influenced by a multitude of factors, including:

The funding market in Northern Ireland has evolved in recent years and has become more sophisticated both in relation to debt and equity funding options.

The traditional debt funding institutions continue to be key in supporting NI SMEs and are now complemented by a range of alternative financiers which when combined can provide businesses with an appropriate structure of funding at a blended cost which is commercial for all stakeholders.

Debt providers will have varying risk appetites and parameters with which they can provide funding and as such there will proposals which are not viable for one funder but can work for others. The level of security required for debt funding will also differ amongst funders, with some requesting a full suite of security and others lending on a cashflow basis rather than relying fully on the strength of the balance sheet. The level of deemed risk and security will directly impact the pricing.

In my experience more businesses are exploring the range of debt options in terms of providers and the variety of products available which are best suited to their working capital needs and will allow the business to meet its strategic objectives within the planned timeframe.

The equity market in Northern Ireland continues to develop with a greater choice of investors across the island of Ireland, the UK and further afield. Equity can be used as a way to finance many different stages of the business and includes seed finance, Angel finance, crowdfunding, venture capital, private equity and IPO/Public offering.

In addition to funding, both debt and equity investors can also bring valuable resource to a business in terms of skills, experience and relationships which can assist with the strategic plans for the business.

So as businesses seek to stabilise and develop their strategic plans it is important that management step back and rethink all aspects of their business including the financing options to understand what their perfect “cocktail” of funding should look like going forward. Management should be open to the idea that the appropriate funding structure could look very different to how the business has been funded to date and that many suitable options now exist beyond the traditional funding options.

If you have any questions we would be delighted to talk to you about your business and funding options and how we may help with your funding for growth, including our products to assist businesses manage the impact of COVID-19.