April 2021

In last week’s home-schooling tasks, Robyn was asked to build a bridge from junk art. I was eager to project manage and tell her about the benefits of Development Finance and how to access it. However, why wife told me the bridge building task is supposed to be fun.

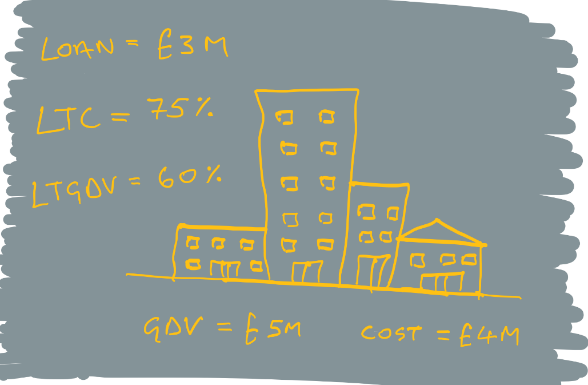

Anyhow, if Robyn had have asked me to expand on the topic of accessing Development Finance, I would have told her the following; it is the term used to describe a loan used to finance the construction of a house, apartment, or commercial building; and when considering loan applications, funders will first wish to understand two key metrics that will form part of their internal credit policy.

Loan to Cost as a % (LTC)

Cost is normally defined as the aggregate of land, construction, professional fees, statutory fees, legal fees, selling fees and finance costs. This metric allows a funder to measure their debt position against the possibilities of time delays or increases to material costs, often referred to as “development risk”.

Loan to Gross Development Value as a % (LTGDV)

Gross Development Value (GDV) is the total sales value of the houses or buildings to be constructed. A funders loan will be repaid from the sales proceeds, so this metric is how they will measure their debt position against sales risk.

LTC and LTGDV percentages vary across funders depending on their appetite for risk and return as well as the nature of the project.

LTC can range from 50% and 80%, with LTGDV often between 45% and 60%.

If the scheme is for 10 houses and the LTGDV is 60%, then the funder would expect to be repaid, in full, from the first 6 houses sold. When lending against apartment schemes funders tend to cap their LTGDV at 55% (apartments are viewed as holding a higher sales risk than individual houses).

If the project meets the funders’ metrics it is likely that they will then ask the developer for their project development plan. When assisting clients, we prepare a detailed document for the funder which covers the SCHEME particulars, expected COST, the developer’s construction EXPERIENCE, the developer’s professional TEAM and the statutory PLANNING position.

SCHEME – what is to be built and where? This will shape the risks associated with the location, competing developments, local demographics and sales price (often measured as £ per sq ft).

COST – one of the most important aspects for funders to fully understand. How much does the Land cost and how much will the Construction cost?

Cost is expressed as £ per square foot. As an example, an entry level semi-detached house may cost £90 per sq ft to build, whereas a large luxury house may be £190 per sq ft driven by the internal fit out and high specification.

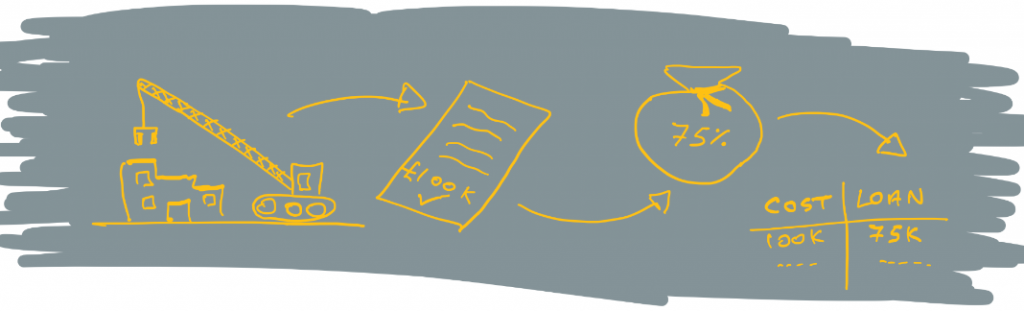

It is at this point the funder will wish to review the developer’s Development Appraisal. This is normally an excel model detailing all the costs associated with the project. A cash flow forecast is essential and should form part of the integrated model. The cash flow allows the developer and lender to understand the build programme, the timing of payments and receipt of sales proceeds. This ultimately outlines the total funding requirement and the profile of the loan. If the total construction cost is £3M the developer will not need the full £3M on day 1. They will draw the loan as a percentage of the cost incurred as at that point in the project. The £3M loan will be fully drawn at the end of the construction.

EXPERIENCE – often funders will give this equal attention alongside COST. As with all lending decisions taken by funders, they want to understand the experience of the developer. Does the developer have the track record of delivering successful projects? If they have not completed a scheme for more than 20 units, it is unlikely that they will have the bandwidth to tackle a scheme for 220 units on their own. Similarly, if the developers experience is mainly building small semi-detached schemes, it is unlikely that they will be equipped to take on a 10-storey apartment block on their own.

TEAM – developers normally engage a team of professionals to assist with different aspects of the build. This team may be external, in-house or a combination of both. Main Contractors will often project manage the construction element engaging with key sub-contractors were appropriate. Civil engineers, Structural engineers as well as Mechanical & Electrical engineers form the remainder of the professional construction team. The developer’s team will also include a Planning Agent, an Architect, a Quantity Surveyor, and a Finance professional.

PLANNING – holding an approved planning permission is crucial, as without it a funder tends not to open a new application. Without a valid planning permission, construction should not begin. If the buildings that have been constructed do not match the approved planning permission, the sale of those buildings will be prevented (mortgage providers will not complete on the sale) with local planning authorities holding the power to demolish those buildings. The date of the approved planning permission is key, as is adhering to the conditions attached to the permission. Obtaining planning permission can take between 6 and 12 months and involves engagement with local and statutory bodies.

How does the flow of loan monies work?

If funders are convinced of the merits of the project and offer a loan, they will “drawdown” that loan on a “staged” basis in line with the build programme. The funder’s independent monitor will visit the project each month, liaise with the developer’s Quantity Surveyor, and agree the total costs incurred to that point. In the example above, the funder advances 75% of the agreed £100K costs incurred. The developer can then make the necessary payments for the materials and labour used to that point.

We have experience in assisting our developer clients to prepare Project Development Plans for funders. We often prepare detailed Development Appraisals with Cash Flow Forecasts by way of support.

If we can assist you or your clients with a development project, please get in touch.

PS – for those interested the bridge was successfully built from cereal boxes and toilet rolls. It was self-funded with no requirement for Development Finance.