January 2021

If you or your advisor have approached your lenders to seek a loan, I have no doubt that one of the questions asked of you was “what is the EBITDA?”.

Lenders love to talk about EBITDA, whether it is past, current or forecast, they cannot get enough of it. Why so? It is the universally accepted measure of cash generation and is used for many financial ratios including debt service cover. More on this in Why Lenders love EBITDA ~ PART 2.

The EBITDA concept was founded by John Malone (now a billionaire) who sold his telecommunications business to AT&T for $48 Billion in 1999. He was attempting to maximise his earnings per share during the sale and came up with the idea as it illustrated a “true cash generation” unaffected by finance or taxation.

EBITDA is an acronym for Earnings Before Interest Tax, Depreciation and Amortisation.

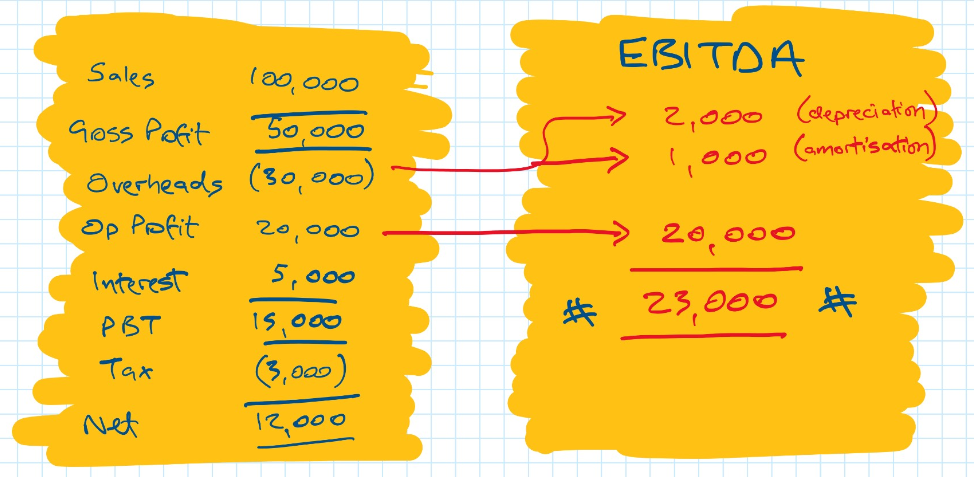

The EBITDA figure is calculated from the financial accounts of a business (statutory accounts, management accounts and forecast).

In the example below, the EBITDA is calculated as £23,000. Included within Overheads is a £2,000 charge of Depreciation and £1,000 charge of Amortisation. As both are non-cash items these are added back to the operating profit to illustrate the EBITDA.

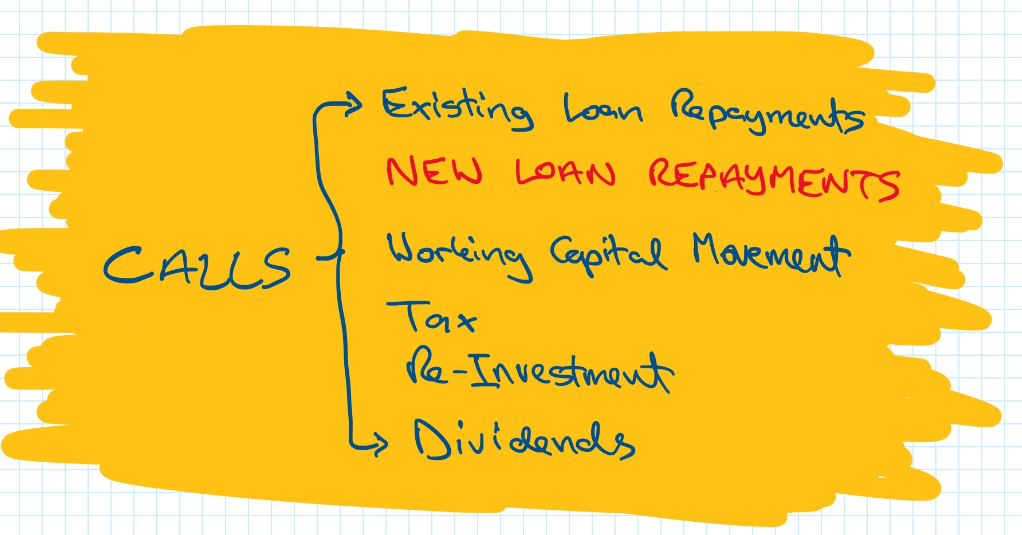

EBITDA is a great comparison tool for businesses within the same sector and is often used as a metric to value companies for sale or purchase. The amount of EBITDA can vary across all sectors as businesses will operate on sector dependent business models ~ some may be high volume/low margin and others low volume/high margin. Comparing the EBITDA of a tech business against a manufacturing business will not produce any meaningful results. Similarly, a large EBITDA value may be a misleading indicator of success as the business may have similar large “Calls”. There a 5 key “Calls” on EBITDA which Lenders will consider when assessing a loan application:

- Finance Cost ~ existing loan repayments and new loans repayments (HP, Bank & Other loans)

- Working Capital Movement ~ this is the annual cash required to keep the business operating (often Debtors plus Stock less Creditors). This is often fully funded by revolving debt facilities such as overdrafts/invoice discounting and can be excluded from the Calls.

- Taxation ~ corporation tax payable

- Re-Investment ~ refers to expenditure on fixed assets which is determined as “unfunded” (i.e. cash expense)

- Dividends ~ cash extracted by the shareholders.

Improving your EBITDA is important. For business owners it allows them to pay higher dividends and achieve a higher sales value (on a multiple basis). It will also demonstrate an increased affordability for loans. EBITDA is regularly shown as a percentage of Turnover (Sales), similar to Gross Profit Margin. Business owners will track their EBITDA percentage through monthly management accounts (trickier if a seasonal business, e.g. a garden centre).

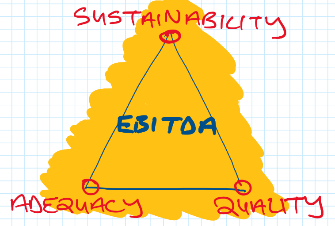

There are three key differentiators that Lenders will reflect on when assessing EBITDA.

Quality ~ this focuses on the quality of the customer base. Is there a reliance within the customer base? How strong is the customer base? How diverse is the customer base? Normally graded Low, Medium or High.

Sustainability ~ this relates to the business sector and position within it. Is there a true strategic market share? Is the sector in growth or decline? Data on competitors and sector performance will have a bearing here.

Adequacy ~ in my opinion the most important measure, as it indicates if a business can meet all its Calls. Over-trading can often be detected here, particularly for low margin, rapidly expanding business with need for continual reinvestment.

In “Why Lenders love EBITDA ~ PART 2” I will discuss the relationship with Debt Service Cover and other extensions of EBITDA, namely EBITDAR and EBITDARM.