January 2021

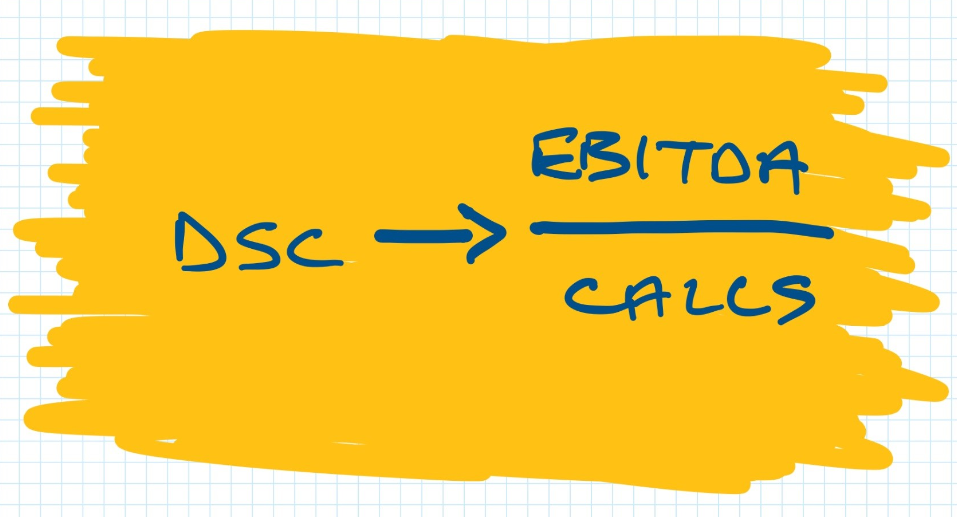

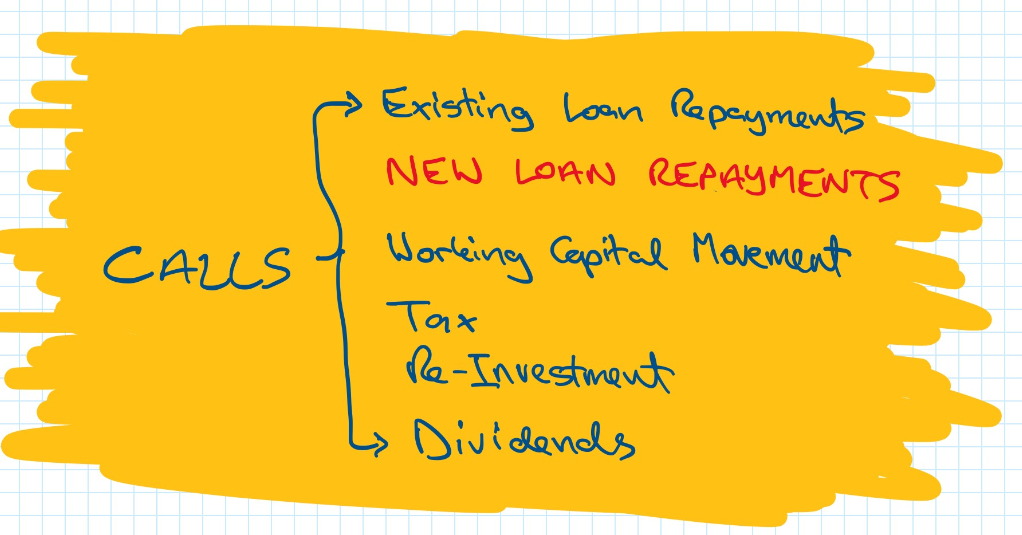

In Why Lenders love EBITDA –PART 1 we described what EBITDA means and how Lenders assess it when considering a new loan request. By considering a business’ EBITDA, a Lender will have a reasonable indication of how much cash a business generates which will be used to repay existing and new loans. This leads to a “Debt Service Cover” ratio, often shortened to “DSC”. Lenders really do love acronyms, they could give airport short codes a run for their money. The DSC sum is relatively straightforward ~ EBITDA divided by Calls. The total Calls will include any proposed new loan repayments.

Most Lenders will apply a “stressed interest rate or stressed margin loading” within their loan repayments, which means they are allowing for any future increases to interest rates. A stressed interest rate may not be applicable if entering a SWAP rates or fixed rate lending. Loan repayments will include Interest and Capital. Often Lenders will calculate the Interest Servicing Cover or ISC. This allows them to understand the EBITDA cover should loan facilities be interest only and not repayment. More common on property investment transactions.

A DSC ratio will need to be greater than 1 to demonstrate that a business can meet its ongoing obligations from current earnings. More often Lenders will wish to see the DSC ratio above their internal hurdle which may vary from 1.25 to 2.0 depending on the business sector and ultimately the Lenders credit policy (reviewed regularly). The reason for an internal hurdle rate is to account for unforeseen increases in “Calls” and/or reductions in future EBITDA (e.g. increased cost of materials or stock, thereby reducing earnings). The purpose of the DSC ratio is ultimately to understand if a business can still meet its obligations including servicing any new loans, should it hit a few speed bumps along the way.

In some instances, particularly when a business is in growth or expansion mode, the DSC from current EBITDA may be less than 1. In this scenario Lenders may consider the forecast EBITDA given that it is the future increased earnings that will repay the loan, not past earnings. Lenders will focus on the robustness of the business’ assumptions and interrogate the “sustainability”, “quality” and “adequacy” of the forecast EBITDA ~ see Why Lenders love EBITDA ~ PART 1 for recap on EBITDA differentiators.

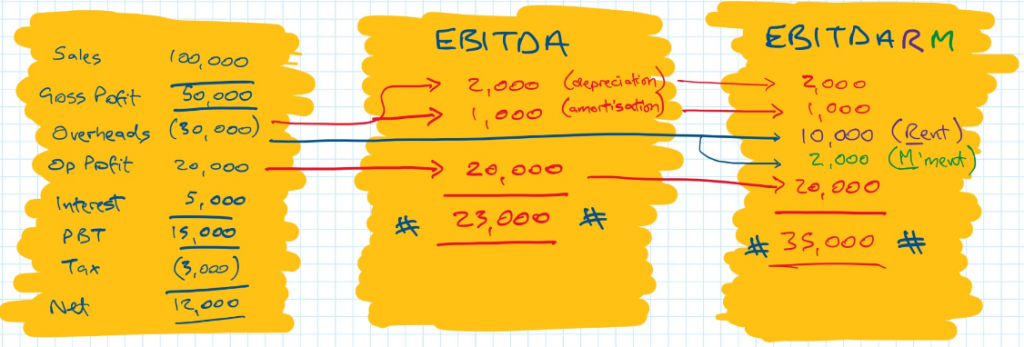

Depending on the business sector, sometimes Lenders will be asked to look at EBITDAR or EBITDARM. These extensions of EBITDA are important to consider when a business is acquiring trading premises or is acquiring another group of companies. The R represents Rent. If a business is currently renting its trading premises and is seeking to acquire its own trading premises, in the future it will no longer be paying rent. By adding-back the Rent cost the EBITDAR will illustrate the true cash generation available to service a new property acquisition loan. The rent currently being paid is essentially being replaced by a loan repayment.

The M represents Management. If a business is acquiring another business, then it is likely that it will absorb the Management cost, often referred to as ‘head office cost’, into its existing overhead base. Head office costs are largely the salaries of senior management who are exiting as part of the sale. Sometimes Management costs can include other “non-cash” charges, for example intercompany charges by way of tax planning exercises. By adding back Rent and Management the acquirer will have a clear picture of the true cash generation and the earnings that the target business will contribute.

In the example below the EBITDAR is £33,000 and EBITDARM is £35,000

Lenders will calculate the DSC from EBITDA, EBITDAR or EBITDARM depending on the nature of the business and purpose of the loan.

DSC can be calculated on past, current and future EBITDA to show a trend. Normally based on the financial year end accounts EBITDA can also be considered on a trailing 12-month basis. This can be extremely useful to demonstrate growth which perhaps is not easily evident from closing dates across statutory year ends.

As relationship brokers, we prepare detailed loan applications in Lender friendly formats. If you would like to talk about your or your clients’ business and its funding requirements, please free feel to contact me directly on 028 9500 1060 or andrewgowdy@whiterockcp.co.uk