March 2021

A hair salon or large retailer, which is the better tenant……? In the current pandemic I could make an equal number of arguments for both. That said, I expect to see longer “socially distanced” queues outside hair salons in the not too distant future.

Residential and Commercial investments can offer attractive returns to investors, particularly if cash at the bank isn’t earning much interest. Of course, there are more inherent risks making investments compared to leaving that cash in the bank, but that is the game of risk and reward.

You may hear investors talking about their IRRs (Internal Rate of Return) and wonder what are they talking about? An IRR allows an investor to measure the profitability of a project. It considers the net cash return alongside the “time value of money”. Models can be as complicated as you want them to be or relatively simple. The time value of money is really important, I remember a 10p mix used to cost 10p. They are now more than 50p in our local sweet shop….

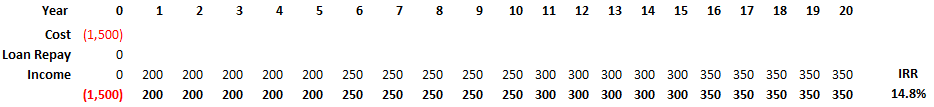

In the example below a £1.5M investment returns an IRR of 14.8%. Why is this important? Well, the IRR is saying that the original outlay of £1.5M would deliver a 14.8% “return on investment” over the 20-year period. As well as providing an indication of profitability, it allows investors to compare various proposals and select the most profitable.

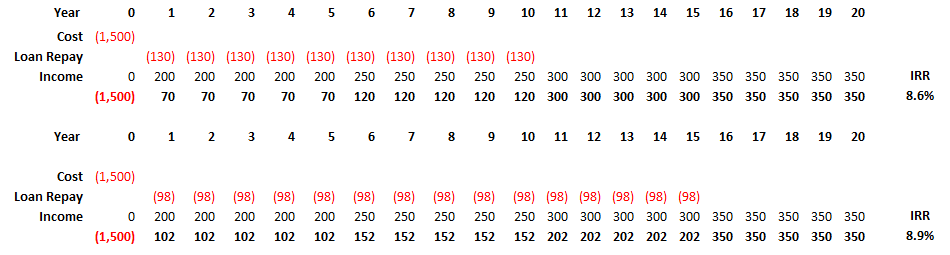

What if the investor needs funding to help buy the asset? Well the IRR will reduce as she will have to pay back the loan, meaning her net cash is less until the loan is repaid. In the example below, she borrows £1M and sets up to repay in full over 10 years, the resultant IRR is 8.6%.

Repaying over a longer period (15-years) actually improves the IRR to 8.9%, despite paying £170K more on loan interest (due to higher net cash received in year 1 to 10).

The challenge for the investor is sourcing the loan with a longer repayment term (often called repayment profile). The longer term improves the IRR, but it will cost an extra £170K in cash over the term as the loan takes longer to repay.

Just like buying a house, investors will visit the assets and make their decisions based on their experience and potential IRR scenarios. Then it’s off to your friendly property broker (other brokers are not available 😊) to source the debt required to complete the purchase.

So, how does a funder approach an investment lending proposal? Well, the answer is that each funder will approach it slightly differently depending on their risk appetite. Some funders are set up to take short-term views, whilst others adopt a longer-term view. There are three key principles that all funders will incorporate in their credit assessment:-

As with any lending application (working capital, development finance and indeed investment finance) a funder will want to understand the borrower’s experience required to undertake a project in order to assess whether they are competent for task. If a first-time property investor is seeking to borrow over £1M for a complex deal it is likely that convincing credentials would be required, as opposed to a seasoned investor with more than 20-years’ experience.

Quality of Income probably bears the most significant weighting, as it is what repays a funder’s loan. In most cases it will be the rental income that will repay a loan, therefore the financial standing of the tenant(s) is very important. Ultimately, a funder will be assessing the likelihood of tenant failing and how that would impact on their loan repayment. Often a funder will request financial accounts for tenants and investigate their credit ratings.

Thirdly, what is the Quality of the Asset? Whilst the quality of the asset is central to a lending decision, it is typically the “second route to repayment” for a lender. It is pledged as collateral should the primary repayment method fail. Assets will typically by described as Low, Medium and High and rated for location, demographics, size, and alternative use.

Funders tend to take higher leverage positions the higher the quality. Effectively they are betting on the forced sale value repaying their loan in full should the primary repayment source fail. This is why a lot of funders will be interested in the “vacant possession value” as well as the “open market value”.

An office block in a city centre probably stands a better chance of reletting and selling, than a purpose-built owner occupier office in a more rural setting.

What is a WAULT?

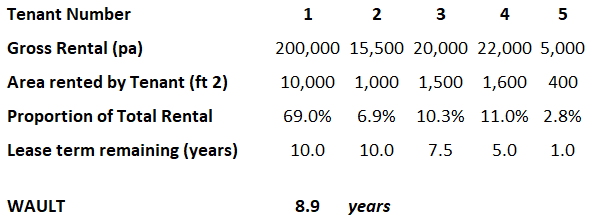

When assessing the “Quality of Income”, a funder will want to understand the WAULT. It stands for the “weighted average unexpired lease term” and is normally expressed in years. The purpose of a WAULT is to give the funder a high-level indication of the average lease time remaining on the asset. To calculate it, you will need the gross rent, square footage occupied and lease expiry date for each tenant.

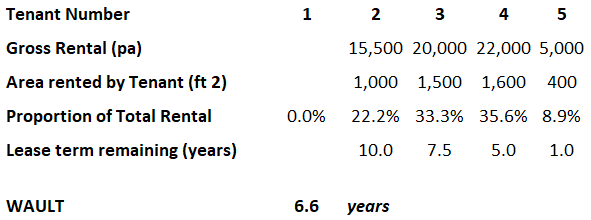

In the example above the WAULT is 8.9 years for the building fully let. If Tenant 1 was to fail and no replacement was found the WAULT would reduce to 6.6 years. Not a significant reduction as they are still 4 tenants remaining with an average of 6.6 years still to go. What is much more important is that the income has fallen from £263K to £63K, meaning the loan repayment could well be under pressure. As Tenant 1 occupies 69% of the floor space, a deeper due diligence exercise by the funder is likely to be undertaken.

The WAULT calculation is great for a quick snapshot on an asset’s lease profile, however they key lending metrics of Debt Service Cover remain the most important test.