June 2021

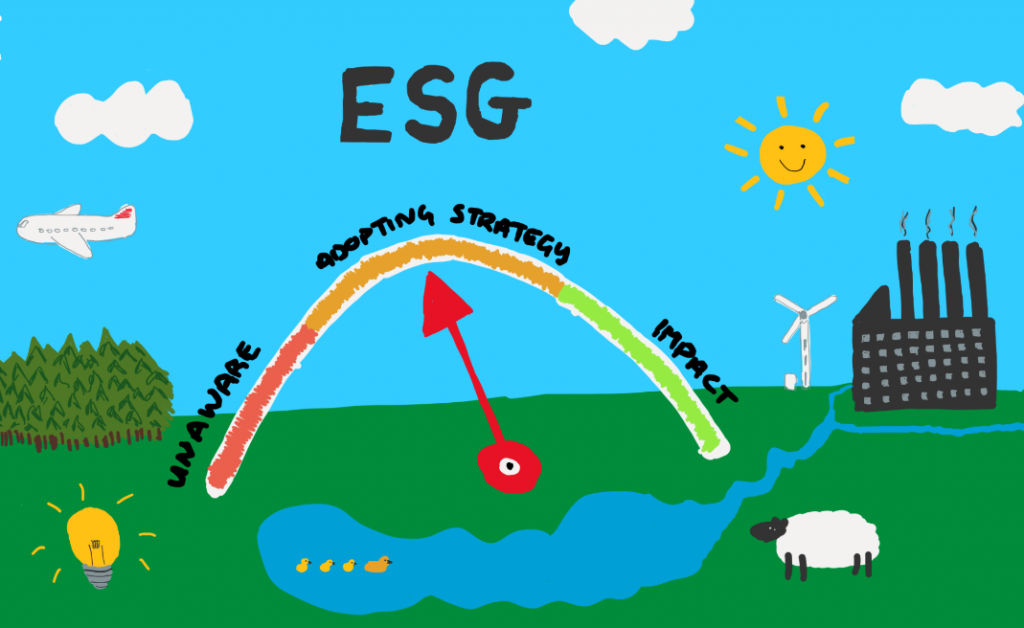

ESG is the internationally recognised acronym for ‘Environmental, Social & Governance’ standard. It helps businesses calculate their impact on the Environment, quantify their Social footprint and measure their approach to Governance.

Whilst ESG has been around for many years, the push to carbon net zero following ‘The Paris Agreement’ has put it on the radar of business owners and investors, large and small.

While business owners have had to prioritise responding to the COVID-19 pandemic over recent months, a global refocus on ESG is requiring firms to better understand the concept, the benefits and where they sit on the ESG dial. Climate change, consumer preferences and regulatory pressures are all driving ESG awareness, making it an agenda item on many boardroom tables.

What is ESG?

The standard is built upon three pillars, with each being underpinned by key themes.

Environmental

- Climate Change (managing Carbon Emissions)

- Energy Efficiency (reducing energy consumption)

- Resource Use (increasing renewables and recycling wastage)

- Pollution (reducing pollution of Air & Water)

Social

- Data Protection & Privacy (ensuring robust policies in place)

- Customer Satisfaction (achieving high satisfaction)

- Community Relations (empathy with surrounding neighbours)

- Employee Relations (engaging the workforce)

Governance

- Board Structure (diversifying board membership)

- Risk Management (creating policies for risk-based decisions)

- Taxation Strategy (creating policies for audit committees)

- Bribery and Corruption (creating policies for prevention)

Why is ESG important?

ESG is important because it elevates the efforts that businesses are making today to mitigate future business risk, curb the impact of global climate change and ultimately generate longer term financial returns by integrating sustainability into decision-making processes. The ESG ratings have become key performance indicators that investors consider when making investments and that lenders have regard to when making credit decisions.

When is ESG being adopted?

There is 2019 UK Government paper presently at consultation stage with stakeholders. It is the UK Government’s plan that listed companies and other companies with large assets, will formally report their ESG disclosures by 2022. In practice, many of these companies already submit their ESG disclosures in conjunction with financial reporting regulations. Implementing ESG practices within all sizes of businesses is warmly encouraged and will ultimately feed into the “net zero carbon goal”.

How is ESG measured?

There is no standard way to measure and report ESG ratings. In fact, the scoring is at best subjective and at worst intangible. Many credit rating agencies use their own internal models when determining ESG ratings. They often use comparison tools and benching marking for various business sectors using indexes, weighted averages, and often simple ‘traffic light’ dashboards. But as ESG becomes more mainstream, measurement and reporting is becoming more standardised.

What are the practical benefits for adopting ESG best practices?

There are plenty of quantitative and qualitative benefits for businesses to realize when adopting ESG best practices. Some can be in the form of quick wins or longer-term investment plays. Examples can be:-

Environmental ~ reviewing and improving ‘energy costs’ often leads to reduced operating costs. By increasing the mix of renewable energy sources or adjusting the timing of energy hungry operations, businesses will find solutions which help the environment whilst at the same time improving their bottom line.

Social ~ having a fully engaged workforce will always outperform a disengaged workforce. If a business can increase its output from same base it will show immediately in financial accounts. A workforce often engages more when non-financial incentives are introduced, such as social enterprises and improved community relations.

Governance ~ a robust corporate governance plan can lead to a reduced cost of capital as investors ‘buy-in’ to the ESG working practices and cultures. Availing of lower cost of capital, the business can take on more projects, achieve higher returns on investment, attract new talent and reinvest.

There can be no doubt that ESG criteria have become firmly established as a standard way to measure how sustainable a business may be in the long term with both lenders using it to screen borrowers and borrowers using it to make them more attractive to investment.

If you would like to chat about your ESG strategy and your funding solutions, contact us on info@whiterockcp.co.uk.